16/11/2025

16/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

16/11/2025

16/11/2025

Word and PDF

Word and PDF

1 page

1 page

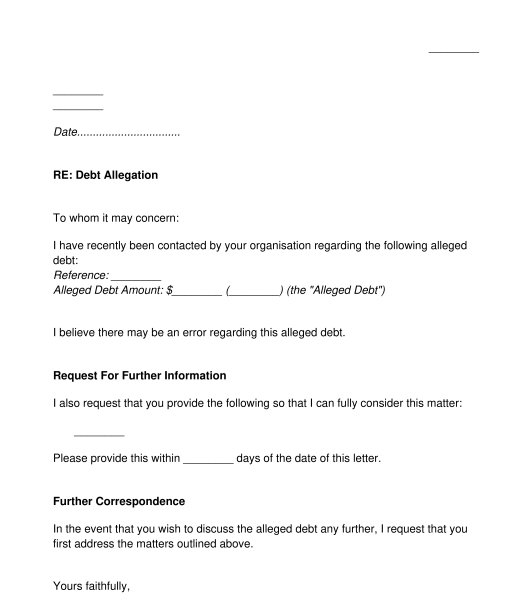

This Letter to Debt Collector may be used by anybody who has been alleged to owe a debt. It may be sent to a debt collection agency, lender, creditor, or any other person or organisation that is alleging that a debt exists.

The letter may be used to dispute the debt entirely, or to assert that the debt is actually less than has been alleged. It may be used to ask for further information or documentation in relation to the alleged debt. It may be used to notify the recipient of the letter that the sender of the letter is experiencing financial hardship. It may also be used to propose a settlement, including an offer to pay a reduced amount, and a proposal regarding a payment schedule. The letter may even be used to notify the recipient that the sender is experiencing harassment from the debt collector or the debt collector's employees.

A person who is alleged to owe a debt can use this letter to get on the front foot with a debt collector, and to take control of any alleged debt.

This letter may be used to respond to a debt collection agency, lender, creditor, or any other person or organisation that is alleging that a debt exists.

If the debt collector does not have many contact details for the sender of the letter, then the sender may want to take care when preparing the letter, not to provide personal information that will help the debt collector to pursue the sender more aggressively. For example, if the debt collector does not know the sender's phone number, then the sender may want to be careful not to enter a phone number when preparing the letter.

Enter relevant information in the letter when prompted. If the sender wants to provide any further documentation with the letter (such as a medical report to verify that the sender is experiencing financial hardship), that documentation can be attached once the letter has been completed.

The letter and any relevant attachments may then be sent to the debt collector.

Importantly, this letter is not designed for use in response to formal court documents. For example, if the debt collector has commenced legal proceedings and has served formal court documents in relation to those proceedings, then it may be necessary to obtain assistance from a lawyer in order to deal with those court documents and to follow court procedures in order to respond.

There are no specific laws that deal with letters to debt collectors. However, debts may arise in a variety of circumstances, and may be affected by a number of areas of law including contract law (as provided by the common law), or various credit related laws such as the National Consumer Credit Protection Act 2009 (Commonwealth) or the Corporations Act 2001 (Commonwealth)

If in doubt, seek legal advice.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Send a Letter

Letter to Debt Collector - sample template

Country: Australia