10/11/2025

10/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/11/2025

10/11/2025

Word and PDF

Word and PDF

3 to 4 pages

3 to 4 pages

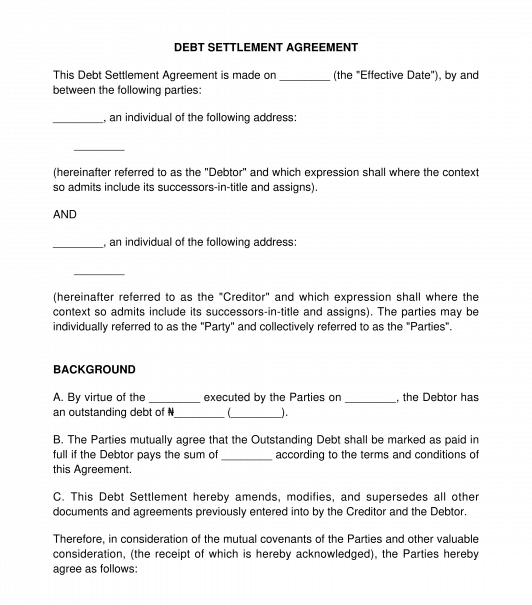

A Debt Settlement Agreement is an agreement between the debtor and creditor to settle a debt owed to the creditor. The debtor is the party that owes money to the creditor. This document allows the parties to negotiate a reduced amount and to propose new terms of repayment.

Sometimes, due to some circumstances, some debtors find it difficult to repay their debt or loan. In cases like this, a creditor can accept a lesser amount from the debtor as a full settlement of the entire sum the debtor owes.

For example, a creditor can use this document to allow a debtor who owes the creditor a sum of N1,200,000 (one million, two hundred thousand naira) and is unable to pay the sum as agreed to pay N700,000 (seven hundred thousand naira) as full settlement of the N1,200,000. This means that if the debtor pays the N700,000 on the date and in the manner described in the Debt Settlement Agreement, the creditor will forfeit the remaining five hundred thousand, while accepting the seven hundred thousand naira as complete payment of the debt. Therefore, the creditor can not pursue the debtor for the remaining N500,000.

This document allows the debtor to pay a reduced amount and the creditor to recoup some of their losses. This way, the debtor will pay a smaller amount and the creditor does not lose the entire money.

How to use this document

This document can be used by creditors or debtors to resolve an outstanding debt. With this document, parties can reach a mutually beneficial arrangement by allowing the debtor to pay a lesser amount as the settlement.

This document requires the full names and addresses of the creditor and the debtor, the original debt, and the reduced amount. After completing the document, it should be printed and signed by both the creditor and the debtor. If either of the parties is a company, two directors of that company should sign the document, and if either of the parties is an organization other than the company, an authorized representative of that organization should sign the document. An authorized representative is a high-ranking officer of the organization, such as the general manager, a managing partner.

Each party should keep a signed copy of the document for their record.

Applicable law

Debt settlement Agreements are regulated by federal and state laws which extend to debt principles. Also, the general rules of contract apply to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Debt Settlement Agreement - FREE - sample template

Country: Nigeria