09/10/2025

09/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

09/10/2025

09/10/2025

Word and PDF

Word and PDF

1 page

1 page

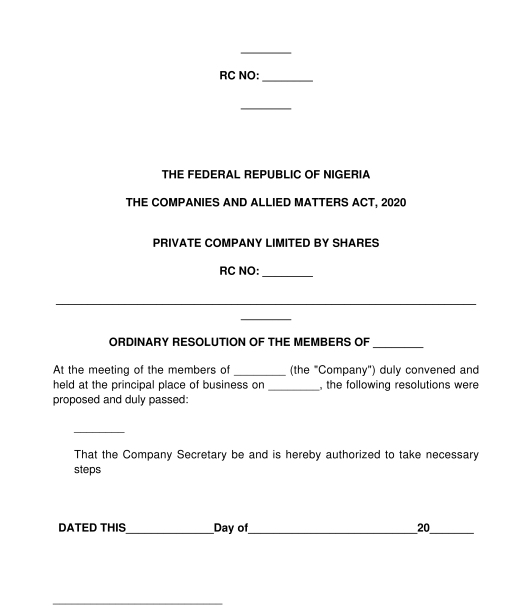

A Resolution of Members of a Company is a document that outlines the key decisions made by the members of a company. A company resolution is the decision made by the members of the company at any general meeting, while a board resolution is the decision made by the directors of the company at any board meeting. Generally, a resolution is made after a meeting has been convened and held. However, the law permits members of a private company to make written resolutions. This requires members of the company may decide without having any meeting. They can make a collective written resolution.

There are two categories of resolution, namely:

For a resolution to pass, it must meet the following criteria:

This document can be used when the members of a company have made decisions relating to the company at a general meeting. These decisions may include, appointment of company directors, change of the company's name, change of business address, change of objects of the company, allotment of company shares financing, or increase or reduction of the company's share capital.

When the document is filled, this document should be signed by either two directors or one director and one secretary.

Once the document is signed, the company secretary or external lawyer needs to submit it, along with the necessary documents and corporate forms, to the Corporate Affairs Commission (CAC). This filing is necessary for updating the corporate records at the CAC.

The Companies and Allied Matters Act, 2020 applies to this document.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Resolution of Members of a Company - FREE - template

Country: Nigeria