04/11/2025

04/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

04/11/2025

04/11/2025

Word and PDF

Word and PDF

5 to 7 pages

5 to 7 pages

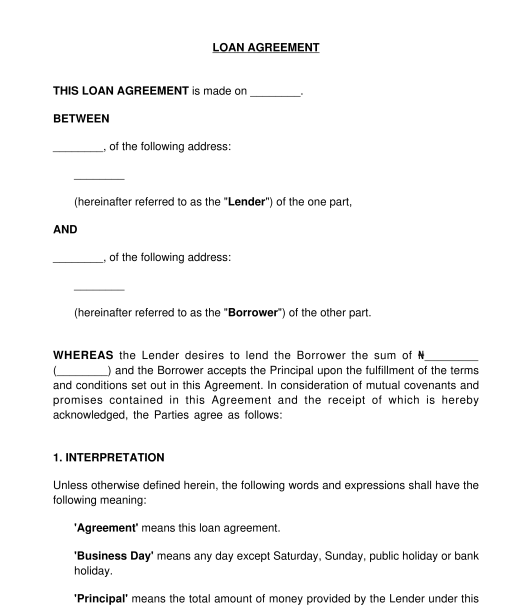

A Loan Agreement, also known as a Loan Contract, is a contract where one party (called the "lender") will lend to another (called the "borrower") a sum of money (the loan).

The Loan Agreement outlines the parties to the loan, the amount which is loaned, the interest rate (if any), particulars of any property deposited as security for a loan (if any) and other terms and conditions which the parties intend to be bound.

There are different types of loans and this depends on the agreement between both parties to the agreement. The types of loans include bridge loans or short-term loans, long-term loans, secured loans, unsecured loans, fixed-rate loans, mortgages etc.

This document can be used for a party who intends to give someone a sum of money with the intention that the money is repaid at a specified date with or without interest.

This document allows the form filler to create a simple loan agreement with the basic requirements and terms, such as particulars of the parties, principal sum, rate of interest, date of repayment of the loan, and obligations of parties to the loan. This document can also enable the form filler to insert terms and conditions the parties intend to comply with.

The following information will be required in this form:

This is the party who accepts the money from the lender and undertakes that the principal will be repaid with interest (if interest is required). The form filler is required to fill in the full name and address of the borrowing party. The borrower can be a person or a registered entity. There could be more than one borrower in this agreement.

Note that if the borrower is a company, the memorandum and articles of association of the company must grant the company the power to borrow money.

The lender is the party giving the money to the borrower on the condition that the principal will be repaid at a specified date with or without interest. The form filler is required to fill in the full name and address of the lending party. The lender can be a person or a registered entity.

This is the total sum of money received by the borrower as a loan.

This is the percentage of the loan that is charged as interest to the borrower. If the interest is charged on the loan amount, the percentage of interest charged must be included in this agreement.

This is the item pledged by the borrower as a guarantee of the fulfillment of the repayment of the loan. The borrower may deposit the title deeds of a real property to the lender who takes the title to the property when the borrower defaults in repaying the loan and interest. The borrower may also deposit personal properties like cars, jewelry etc, on the condition that in the event of default in repaying the principal and interest, the lender has the right to sell the security deposited to satisfy the loan and the interest.

Some loan agreements do not require that the borrower deposits anything as security for the loan. Sometimes, the borrower uses a guarantor who will undertake to repay all outstanding sums in the event of default by the borrower. Also, some parties agree that a lien be put on the borrower's bank account and the lender gets repaid from the registered account of the borrower in the event of default.

After filing this form, each party is required to sign the document and the parties must ensure that their signatures are witnessed by persons who are at least 18 years old. Where any of the parties is a company, the common seal of the company must be affixed on the document and the document must be witnessed by either two directors or one director and one secretary, who will sign the document. Where the lender has requested guarantors, the guarantors must read the document carefully and sign same. The signatures of the guarantors must also be witnessed by persons who have attained the age of 18.

Where the loan is a mortgage, the lender must register the mortgage at the Lands Registry of the State where that land is situated or at the Federal Ministry of Housing and Urban Development, if the land is federal land. In registering the mortgage, the parties will execute a deed of legal mortgage and accompany same with other documents.

The general law of contract applies to this agreement. If the lender is a money lender, the Money Lender Act and Money Lender Laws of the various States in Nigeria will be applicable.

If the borrower will deposit any personal property (other than land or building) as security for the loan, the Nigerian Collateral Registry Act will be applicable, which states that such personal property must be registered. If it is a mortgage, the Conveyancing Act, Property and Conveyancing Law and other relevant property laws will be applicable.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: How to Recover Money from a Debtor

Loan Agreement - FREE - sample template - Word and PDF

Country: Nigeria