22/11/2025

22/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

22/11/2025

22/11/2025

Word and PDF

Word and PDF

1 page

1 page

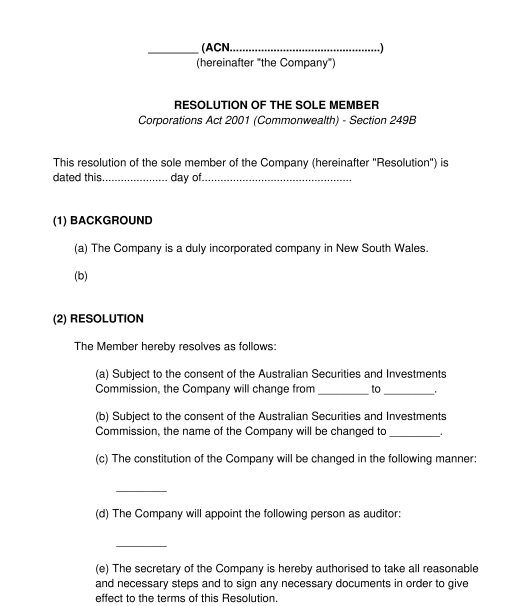

This Members' Resolution is for use when the member(s) (also known as the shareholder(s)) of a private company intend to pass a resolution without having a meeting. It is often referred to as a "Circulating Resolution". If the resolution is being passed by the directors of the company (without having a meeting), use our Directors' Resolution document instead. If the resolution is being passed by Directors at a meeting, use a Minutes of Directors' Meeting document.

This document may be used by companies with a single member ("single-member" companies), or those with multiple members ("multi-member" companies). In the document, it is possible to select from a range of common resolutions, or to enter the details of one or more other resolutions (which are not covered by our common options).

Public company or private company

This Members' Resolution is only designed for use by private companies (also known as proprietary companies). Under the Corporations Act 2001 (Commonwealth), (the "Act") public companies cannot use circulating resolutions. Instead, the members in public companies must meet in person in order to pass a resolution.

There are many differences between a public company and a private company under Australian law. The main difference is that members of the public are able to invest in public companies, whereas they are not able to invest in private companies. However, along with this, there are many other differences, particularly in relation to regulation, compliance and reporting. The relevant company will have been set up either as a private company or a public company when it was first established. Or, in some cases, it may have changed from one structure to another at some later date.

The Australian Securities and Investments Commission provides further information about private and public companies.

For a more general discussion about starting a business in Australia see our guide How to Start a Business in Australia. For a discussion of some other legal structures in Australia, see our guide How to Choose the Best Legal Structure for your Business.

Members' resolution or directors' resolution

Under the Act, most of the decisions that affect a company need to be made by a resolution. A company's constitution and/or Shareholders' Agreement (if the company has a shareholders' agreement) might also set out what sorts of decisions need to be made by resolution.

It is also important to note that under the Act, some kinds of decisions must be made by a members' resolution rather than a directors' resolution.

Generally speaking, directors' resolutions relate to the day to day running of a company. For example, a decision to enter a particular contract, or to grant or revoke somebody's signing authority, might be able to be made by directors' resolution.

On the other hand, members' resolutions may be required for decisions that relate to the fundamental details of the company, rather than day to day business matters. For example, decisions relating to the following matters generally require a members' resolution rather than a directors' resolution:

However, different rules may apply to different types of company. In addition, the company constitution and shareholders agreement (if there is a shareholders agreement) might also say something about how certain decisions must be made (ie whether they should be made by directors or members, and by ordinary resolution or special resolution). Therefore, if in doubt, seek legal advice.

This document is intended for use in the case of members' resolutions. It is not appropriate for the types of matters that require a directors' resolution (use our Directors' Resolution document for those matters instead).

Meeting or no meeting

Section 249A of the Act permits resolutions to be passed by multi-member companies without a meeting, if all the members entitled to vote on the resolution sign a document containing a statement that they are in favour of the resolution set out in the document. Section 249B of the Act permits resolutions to be passed by single-member companies by recording the resolution and signing the record.

However, even though these sections 249A and 249B of the Act say that the company may pass a resolution in either of these ways, it is possible that the company's constitution and/or shareholders' agreement might actually state that for this particular company, some other procedure must apply. For example, for a multi-member company, the constitution might state that the members must actually hold a meeting. Therefore, it is important that the person preparing this document first consults the company's constitution and shareholders' agreement (if applicable), to confirm whether either document sets any additional procedural requirements for the passing of resolutions.

This document is intended for use when the company is passing a resolution without having a meeting. If a resolution is being passed at a meeting, use a Minutes of Shareholders' Meeting document instead.

The document must be signed by all members entitled to vote on the resolution

It is also worth noting that for multi-member companies, there are several different types of resolution which may be passed by the company (at members' meetings):

However, section 249A of the Act clarifies that for a resolution to be passed without a meeting, all of the members entitled to vote on the resolution must sign the document. Therefore, even for the types of decisions that could normally be passed at a meeting by a special resolution (at least 75%) or an ordinary resolution (more than 50%), if the resolution is going to be passed without a meeting, all of the members entitled to vote on it (ie 100%) must sign the document.

As a result, these circular resolutions (without a meeting) can provide a convenient option when 100% of the members are likely to agree. However, if any members are likely to disagree with the resolution, or if the resolution is somewhat complicated and needs to be discussed in person, these circular resolutions may not be appropriate. Instead, a members' meeting (with the outcome recorded in a Minutes of Meeting document) might be preferable.

Further information is available from the Australian Securities and Investments Commission.

How to use this document

This document provides a basic template for the recording of various kinds of members' resolutions. However, to ensure that the document is legally effective, it may be necessary to consider relevant rules which apply to the company.

As previously discussed, it is important to first consider any legal requirements which may apply, depending on the nature of the company or the types of resolution(s) that are being passed. These requirements may be set out in the Act and further information may be provided by the Australian Securities and Investments Commission.

Make sure that the matters with which the company is dealing can actually be handled by way of a circulating members' resolution (rather than by members' meeting or by directors' resolution). Also consider whether the company constitution and any shareholders' agreement permits the proposed resolution to be passed without a meeting.

This document will need to be signed by all members entitled to vote on the resolution(s). Unless the constitution and/or shareholders' agreement state otherwise, the members may all sign and date the same copy of the document, or the document may be signed in counterparts (meaning each member signs and dates a different but identical copy).

The resolution is passed when the last member signs it.

Section 251A of the Act requires that a record of the resolution be recorded in the company's minute books within one month of the resolution having been passed.

In addition, for many types of resolution, the Australian Securities and Investments Commission requires specific forms to be lodged. Further information, as well as links to the relevant forms, are available on the webpage of the Australian Securities and Investments Commission.

If there are any concerns, seek legal advice.

Applicable law

The Corporations Act 2001 (Commonwealth) applies to many company matters, including members' meetings.

In some cases, the Income Tax Assessment Act 1936 (Commonwealth) may also apply, for example when dealing with a public officer.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Members' Resolution (for Private Company) - template

Country: Australia