10/10/2025

10/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

10/10/2025

10/10/2025

Word and PDF

Word and PDF

4 to 6 pages

4 to 6 pages

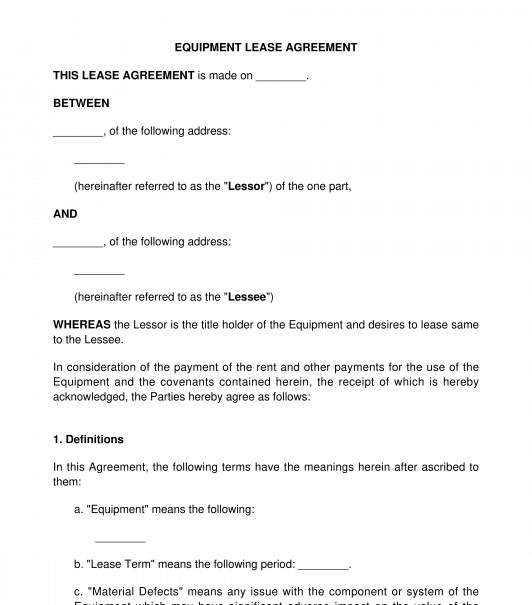

An Equipment Lease Agreement is an agreement where the owner of an equipment permits another to use the equipment in exchange for a periodic lease payment. The owner of the equipment is the lessor, the user of the equipment is the lessee. An equipment that can be leased includes any physical property such as vehicles, machinery and other tangible properties. Note that this document can not be used to rent land or building, as the Residential Lease Agreement and the Commercial Lease Agreement are available for this purpose.

This document can be used for operating lease and long term or financial lease. Operating leases are short term leases wherein the lessor usually bears all the risks in the agreement, such as insurance, repairs, maintenance etc. This type of lease is usually adopted by parties that need the equipment for a short period of time. Examples of equipment used for this type of lease include office equipment (such as computers, office furniture, etc), vehicles etc.

Financial leases are long term lease. In this type of lease, the lessee is usually responsible for maintaining and insuring the equipment and payment of all taxes, if applicable. This type of lease is usually used by businesses that intend to use expensive capital equipment over a long period of time. For this type of lease, the lessor may give the lessee the option to purchase at the end of the lease term therefore, transferring the ownership of the equipment to the lessee if the lessee exercises that option.

Usually, equipment leases are used for the following reasons:

This document outlines the particulars of the parties, duration of the lease, amount of rent, the obligations of the parties, insurance policy, tax responsibility of the parties, remedies for breach of contract, etc.

How to use this document

This document can be used by individuals, companies and any other organization that intend to lease any equipment owned by it. Note that there may be more than one lessor or lessee in this agreement.

After filling the form, the lessor(s) and lessee(s) must sign at two or more original copies of the document. If the lessor(s) is a company, the common seal of the lessor must be affixed on the document and the director(s) of the company should sign the document. If the lessor(s) is an organization other than a company, the document must be signed by a person in position of authority in the organization (for example, the General Manager, Managing Partner, etc.).

The lessee(s) should also sign all the original copies of the document. If the lessee(s) is a company, the common seal of the company may be affixed on the document and the director(s) of the company should sign the document. If the lessee(s) is an organization other than a company, the document must be signed by a person in position of authority in the organization (for example, the General Manager, Managing Partner, etc.).

Note that the law states that at least a copy of the agreement must be delivered to the lessee(s) within 14 days after making the agreement. After the document has been signed by the parties, each party must keep at least one original copy of the executed document for record purposes.

After this is done, the agreement must be registered with the Equipment Leasing Registration Authority not later than 14 days after the commencement of the lease. The Registration Authority will issue a certificate of registration after the registration process has been completed.

Applicable laws

The Equipment Leasing Act is the applicable law. Also, the general rules of contract apply to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Equipment Lease Agreement - FREE - sample template

Country: Nigeria