05/11/2025

05/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

05/11/2025

05/11/2025

Word and PDF

Word and PDF

1 to 2 pages

1 to 2 pages

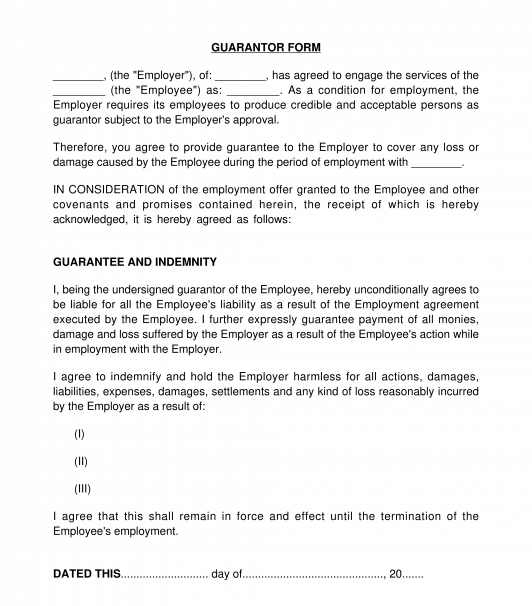

A Guaranty Agreement is a contract by which a guarantor agrees to settle the debts of another person where the person is unable to pay their debts. In other words, the guarantor assumes liability for the debts owed by the debtor in the event the debtor fails to pay.

The guarantor is a party that undertakes to satisfy a debtor's debts in the case of default. The guarantor may, depending on the nature of the contract deposit a tangible asset (such as, land, building vehicle, etc) as collateral, which will be sold and used for the satisfaction of the debts in the event that the guarantor does not pay the entire debts he has guaranteed.

This document can be used in the following contexts:

Note that in loan agreements or finance, the borrower or debtor has the primary liability towards the lender, as the liability of the guarantor only arises in the event of the debtor's default.

The extent of a guarantor's liability may be limited or unlimited. A guarantor's liability is unlimited when they guarantee to pay all the the borrower's debts, including principal, interest, and default fee except the parties agree otherwise. A guarantor's liability is limited if the guarantor covenant to pay only a specific sum in the event of the borrower's default.

For example, if a guarantor has guaranteed to pay the sum of ₦50,000, and the Borrower is in debt of ₦100,000 and is unable to pay back that sum, the guarantor is only liable to pay the ₦50,000 (being the amount guaranteed) and the lender or creditor must pursue the borrower for the remaining balance - ₦50,000.

How to use this document

After completing this document, the document should be printed and signed by all the parties to the agreement.

If either of the parties is a Nigerian company, either two director or one director and one secretary should sign the document and affix the common seal of the company to the document.

If either of the parties is an organization other than a company, an officer of the organization should sign the document and ensure that a witness attests the document by writing their name, address, occupation and signature in the row right below the signature of the officer in the document.

Each party should keep at least one signed copy of the document for record purposes.

Applicable law

The general rules of contract are applicable to this document.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guaranty Agreement - FREE - sample template

Country: Nigeria