22/10/2025

22/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Rating: 4.6 - 156 votes

Fill out the templateA Loan Agreement is a document which records the terms and conditions of a loan made between individual persons or companies.

It usually includes information about who lent the money, who they lent it to, how much they lent, when it needs to be repaid, and how much interest will be charged.

A Loan Agreement can be used for a variety of different loan types. In order to document more basic lending arrangements, consider using a Promissory Note.

A Loan Agreement sets out all of the terms of a loan, whereas a Promissory Note is effectively a promise to pay a sum of money, and is often shorter and less detailed than a Loan Agreement. A Promissory Note is useful if the parties need a quick and simple document to provide written evidence that one party owes money to the other party.

A Loan Agreement generally includes more details than a Promissory Note does (such as interest rates or repayment schedules). A Loan Agreement is also more suitable for more complex or formal arrangements.

A Loan Agreement is usually signed by both parties whereas a Promissory Note might only be signed by the borrower.

A Loan Agreement sets out all of the terms of a loan, whereas an Acknowledgement of Debt is a simple letter confirming that one party owes money to the other party. It does not usually deal with loan terms such as repayment dates or interest rates. It is usually used to acknowledge an existing debt.

A Loan Agreement generally includes much more detail than an Acknowledgement of Debt does, and is prepared before any money is actually provided to the borrower by the lender.

No, but it is recommended to use a written agreement to ensure that all of the agreed terms are understood by both parties. A written Loan Agreement also protects both parties and allows them to enforce their rights (for example, by going to court) if the other party does not comply with the agreement.

Many people think a written agreement is not necessary between friends and family as they never intend to sue each other. However, in reality a written Loan Agreement is a simple way to ensure that everyone is on the same page and there is no misunderstanding about how and when the money should be repaid.

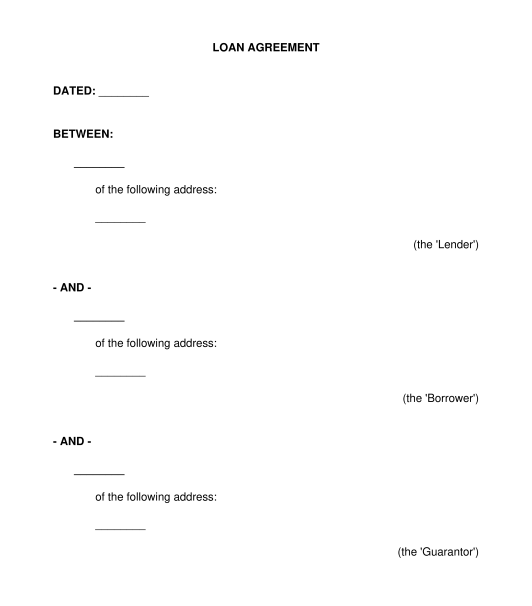

The two main parties to a Loan Agreement are the lender and the borrower. However, it is possible for there to be multiple lenders, and/or multiple borrowers. For example, two parents might lend money to one of their adult children, and that child's spouse.

In addition, some Loan Agreements also include one or more guarantors. A guarantor is a person or entity that agrees to repay a loan if the original borrower fails to do so.

All of the parties under a Loan Agreement (lenders, borrowers and guarantors) can be individual people, or can be companies or other legal entities.

All parties, including the borrowers, lenders and any guarantors (if applicable) should review the Loan Agreement and make sure they are happy with the terms. Once all parties have approved it, they can sign the agreement in the relevant space, and the agreement can be dated.

If individuals are having their signatures witnessed, they should ensure that the witness is an independent adult person (over the age of 18).

All parties should keep a copy of the fully signed Loan Agreement for their own records.

No, witnesses are not mandatory for a Loan Agreement, but they are useful for evidentiary purposes. If there is ever a dispute over the Loan Agreement, witnesses can help to prove that each party's signature is valid.

Witnesses should be independent adults (aged over 18), who have the mental capacity to understand what they are doing. They should not be related to one of the parties.

No, it is not mandatory for the Loan Agreement to include interest. This is up to the parties.

In some loans between friends and family (such as loans from parents to their children), there may not be any interest.

However, in most other loans, it is common to charge interest.

A guarantor is a person who receives no direct benefit from the loan (i.e receives no money from the lender) but takes on the responsibility to repay the loan on behalf of the borrower if the borrower fails to repay the loan.

It is relatively common for parents to act as guarantors on loans for their children. If the child fails to repay the loan, then the lender may seek payment from the parent.

In some Loan Agreements, the lender requires the borrower to provide security (also referred to as collateral) for the loan. This security is something of value that the borrower offers to the lender as some protection in case the borrower defaults on the loan. For example, it could be a piece of real estate, a vehicle, some equipment, or some jewellery.

If the borrower fails to comply with their repayment obligations, then the lender may seize the security to cover the debt.

If the borrower is providing security for the loan, then the lender may need to take further steps to rely on that security such as registering it on the Personal Property Securities Register. The parties may also wish to prepare a Security Agreement in relation to the loan security.

Most Loan Agreements include some provisions dealing with missed payments. Often, the borrower will be charged late fees and in some cases the lender may be entitled to terminate the agreement and demand repayment of the full loan amount.

Once a payment is missed, the lender should provide written notice of default to the borrower. If the matter is not promptly recitified by the borrower, then the lender may send a Letter of Demand. Often, the lender and the borrower then work out a payment arrangement, which may involve giving the borrower a bit more time to repay the debt.

If there are guarantors included in the loan, then the lender could seek payment from the guarantors. If the borrower has provided security for the loan, then the lender could ultimately look to seize the security to cover the debt. The lender may also consider commencing legal action against the borrower for the debt.

The following details need to be included in a Loan Agreement:

The following details can be included in some (but not all) Loan Agreements:

A Loan Agreement is subject to the broad principles of contract law.

Where the borrower has provided security, lenders may wish to 'perfect' that security in accordance with the provisions of the Personal Property Securities Act 2009 (Commonwealth).

In some cases, if a loan deals with complex matters, the note may be deemed a complex financial product and may fall under the Corporations Act 2001 (Commonwealth) meaning that additional legal obligations may apply.

If a lender is a company, and the Loan is being provided to a shareholder of that company, parties should be aware of division 7A of the Income Tax Assessment Act 1936 (Commonwealth). Where the parties believe that division 7A applies to the Loan, they may wish to use an alternative agreement – the Division 7A Loan Agreement.

If the lender is in the business of providing loans, the provision of the National Credit Code under the National Consumer Credit Protection Act 2009 (Commonwealth) may apply. Lenders should review whether the provisions of that Act apply to their lending activities and ensure that they are in compliance with the rules that apply to Australian credit licence holders by tailoring this agreement accordingly.

If in doubt, the parties should seek legal advice.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Loan Agreement - sample template online - Word and PDF

Country: Australia