29/11/2025

29/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

29/11/2025

29/11/2025

Word and PDF

Word and PDF

5 to 6 pages

5 to 6 pages

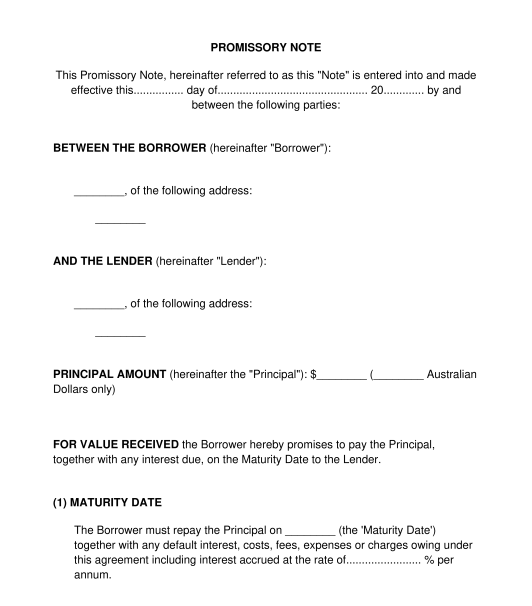

A promissory note is a document that records a promise to pay a sum of money. It is a relatively simple document and is a good option where a person or company wishes to record a loan or promise to pay a small sum of money.

The document can record details of the borrower's and lender's names, the sum of money loaned (or credit extended), the interest charged by the lender and a timeline for the repayment of the money.

A promissory note offers several repayment options including fixed instalments, repayment on a set date or repayment upon demand by the lender. The document can also be used for short-term, simple loans or offers of credit.

For more complex loans, consider using a Loan Agreement.

No, it is not mandatory to have a promissory note; however, it is advisable to have one. The document creates a written record of the debt and helps clarify the terms of the debt and protect the interests of both parties.

A loan agreement is a more complex and detailed contract between a lender and a borrower. A loan agreement generally includes more details than a promissory note does (such as interest rates or repayment schedules).

On the other hand, a promissory note is a shorter and simpler document wherein the borrower makes a promise to repay the lender at an agreed time. As such, a promissory note is more likely to be used in less formal situations where the parties have an existing relationship (e.g. between family members and friends).

The original document can be signed by the borrower and then provided to the lender. The lender may sign the document as well. However, unlike a loan agreement, a promissory note will still be legally effective even if the lender does not sign it.

The lender can keep the original document until the loan has been repaid, and provide a copy to the borrower. The borrower should retain a copy of the document so that they have a record of the terms of the loan.

If the loan is to be repaid on demand, the lender may demand payment by presenting the document to the borrower together with a written request for repayment of the loan.

Upon full repayment of the loan, the borrower may request that the lender write the words "Paid in Full" on the original copy of the promissory note and return it to the borrower.

No, witnesses are not mandatory for a promissory note, but they are useful for evidentiary purposes. If there is ever a dispute over the promissory note, witnesses can help to prove that each party's signature is valid.

Witnesses should be independent adults (aged over 18), who have the mental capacity to understand what they are doing. They should not be related to one of the parties.

A promissory note is usually valid until it is paid. If no due date is specified, then it is usually payable on demand and is valid until then.

If the due date for payment has passed, or if the lender has demanded payment, but the borrower has not repaid the debt, then the note may be valid for another 6 years in accordance with the Statute of Limitations in Australia. Once the 6 year limitation period has passed, the lender may no longer be able to enforce the promissory note in court.

This usually depends on the terms of the promissory note. The note might specify a due date for payment. Alternatively, if no due date is specified, then it is usually payable on demand.

The following details should be included in a promissory note:

It is important to note that if complex terms are written into the document, then it may fall under the Corporations Act 2001 (Commonwealth), meaning the parties may face additional legal obligations. Complex terms could involve things like derivatives (such as options contracts or futures contracts), managed investment schemes, or syndicated loans. If the document falls under the Corporations Act 2001 (Commonwealth) the parties could be subject to significant regulatory obligations such as disclosure requirements (including the requirement for a Product Disclosure Statement), and a requirement for the lender to hold an Australian Financial Services Licence. Failure to comply with these obligations can lead to significant penalties.

If the borrower does not repay the debt when it is due or when demanded by the lender, then the lender may consider sending a Payment Reminder. If the borrower still does not pay it, the lender could send a Letter of Demand and then consider commencing legal action.

Promissory notes are addressed in the Bills of Exchange Act 1909 (Commonwealth).

In some cases, if a promissory note deals with complex matters, the note may be deemed a complex financial product and may fall under the Corporations Act 2001 (Commonwealth) meaning that additional legal obligations may apply.

Importantly, if the lender is in the business of providing credit, and if the credit is provided for personal, domestic or household purposes, or for the purpose of purchasing, renovating or improving residential investment property, then the National Consumer Credit Protection Act 2009 (Commonwealth), including the National Credit Code (which can be found at Schedule 1 of that Act) may apply. This may also impose additional legal obligations. Further information is available on the website of the Australian Securities and Investments Commission.

If in doubt, seek legal advice.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Promissory Note - sample template online - Word and PDF

Country: Australia