06/11/2025

06/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

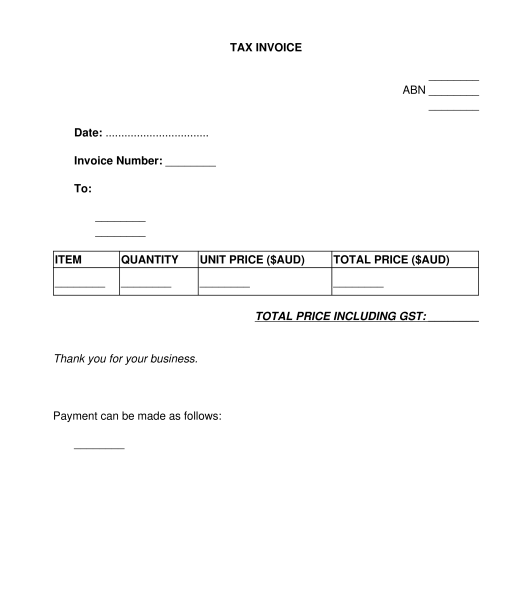

A Tax Invoice is for use by a business (whether a sole trader, company, or something else), when charging a client or customer for goods or services.

A Tax Invoice is a particular kind of invoice which shows the amount of tax payable in relation to the goods or services that are being sold. If a business charges tax on the goods and services it sells, then the business should provide a tax invoice to show the tax that is being charged.

Most businesses in Australia use Tax Invoices. If a business is registered for Goods and Services Tax (GST) then the business is usually required to provide a Tax Invoice, which includes any applicable taxes.

If a business is not registered for GST, then its invoices will not include a tax component and should not include the words "Tax Invoice". Instead, the business will provide a simple invoice or regular invoice.

Tax law in Australia is complicated but in most cases, if businesses earn more than a specified amount per year, then they need to register for GST and use Tax Invoices. Businesses that earn less than that amount may not need to register for GST, but could choose to. Further information about registering for GST and issuing Tax Invoices is available at business.gov.au.

Yes. If the business is registered for GST then it must provide tax invoices to its customers/clients.

A Tax Invoice should not be used by businesses that are not registered for GST. Instead, those business should use a simple invoice and should not collect GST from their customers.

Before preparing a Tax Invoice, the business should make sure to be registered for GST.

A Tax Invoice can be provided before or after the goods or services have been delivered to the customer. Some businesses like to receive payment in advance, while others (especially service based businesses) may invoice the customer afterwards.

Most businesses choose to send this invoice together with a copy of a Cover Letter for Invoice. The Cover Letter for Invoice presents a professional and polite message to customers, as well as the option to include further explanation about the purpose of the invoice. Most businesses find that this increases the likelihood that customers will return to the business in future.

Once the invoice (and if applicable, the Cover Letter for Invoice) have been prepared, they may be sent to the client or customer. If they are being sent in hard copy, they may be printed, the letter may be signed and attached to the front of the invoice. If the invoice is being sent by email, the letter may be attached to the email along with the invoice.

Both parties should keep a copy of the invoice for their own records. If either party is ever audited by the Australian Taxation Office, then they may need to provide a copy of the invoice.

It is not mandatory to attach anything to the Tax Invoice. However, many businesses choose to attach a copy of a Cover Letter for Invoice.

For sales under $1,000, a Tax Invoice must include enough information to clearly identify:

For sales over $1,000, a Tax Invoice must also include the customer's identity.

Tax law in Australia is complex. The rules regarding Tax Invoices primarily fall under the A New Tax System (Goods and Services Tax) Act 1999 (Cth). The Taxation Administration Act 1953 (Cth) is also relevant to the administration and enforcement of tax laws.

Further information is available from the Australian Taxation Office and from business.gov.au.

If in doubt seek legal and/or taxation advice.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

Tax Invoice - sample template to fill out Word and PDF

Country: Australia