23/11/2025

23/11/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

23/11/2025

23/11/2025

Word and PDF

Word and PDF

1 page

1 page

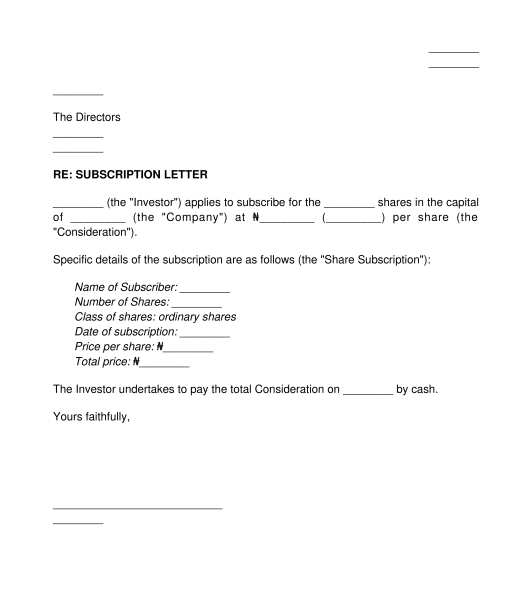

The Share Subscription Letter is an application to subscribe the shares of a company. An investor uses the letter to indicate their interest in acquiring the shares of a company.

When a small company wants to raise capital, it seeks investment from private investors. During this period, private investors can indicate their interest in acquiring some shares in the company.

This document is different from the Share Subscription Agreement in the sense that the latter is more elaborate as it contains the warranties of the company whose shares are being subscribed, pre-sale conditions, and post-sale conditions and other information that discloses the state of affairs of the company.

This document contains the information of the investor that is subscribing to its shares, the number and type of shares that they are subscribing to, and the price per share. It is straightforward and does not require any obligations from either of the parties.

Note that only companies that offer shares can use the Share Subscription Letter. Other entities like companies limited by guarantee, business names, and incorporate trustees cannot use this letter because they do not offer company shares in exchange for an investment.

This document is used when an investor wants to acquire the shares of a company. This is a simple document that requires the full name and address of the company, the name and address of the investor, number and price of shares that are being issued.

After completing the document, the new investor should sign the document. If the investor is a company, the document should be signed by two directors or one director and one secretary. If the investor is an organization other than a company, an authorized representative of the organization must sign the document.

After signing, the investor should send the document to the company whose shares the investor wants to buy. If the company agrees to issue shares to the investor, the company will send the Subscription Agreement, Shareholders Agreement, and any other legal documentation.

After this, the company must take steps to ensure that the name of the investor is entered in the register of members of the company (if the investor is not already a member of the company).

The Companies and Allied Matters Act, 2020 applies to this document. Also, the Investment and Securities Act and the Securities and Exchange Commission (SEC) Rules apply to the allotment of the shares of a public company. The general rules of the contract are also applicable to this document.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Share Subscription Letter - FREE - sample template

Country: Nigeria