29/10/2025

29/10/2025

Answer a few questions and your document is created automatically.

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

29/10/2025

29/10/2025

Word and PDF

Word and PDF

9 to 11 pages

9 to 11 pages

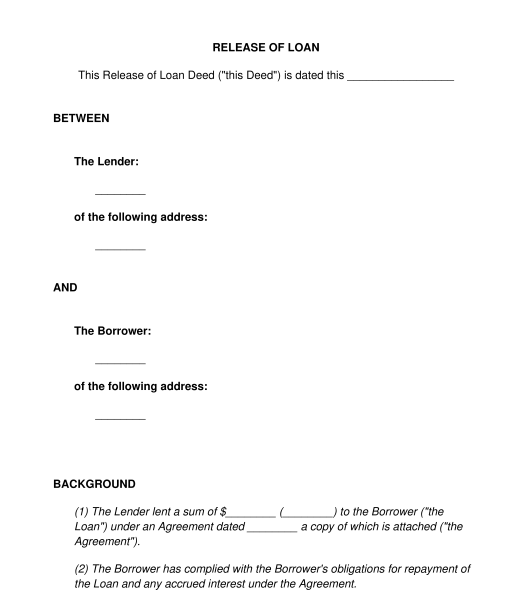

A Release of Loan Agreement is given to a Borrower by the Lender once the terms of the Loan Agreement are satisfied.

This generally means that the Borrower has finished paying the Lender back the amount of money originally lent, plus any accumulated interest, if applicable.

This document creates a written record of the release, which the Borrower can keep on file and can use as evidence that the loan has actually been repaid.

A Loan Agreement is used when one party is planning to lend money to another party. It is prepared before the money is lent.

A Release of Loan is for use at the end of the loan - after the money has been lent and then paid back.

Alternatively, a Promissory Note is similar to a Loan Agreement, but is for more simple debts.

To prepare a simple loan in the first place, or to simply record a debt that is owed, use a Promissory Note. Alternatively, to prepare a more complicated loan, use a Loan Agreement.

No, but it is recommended to provide both parties with clear documentation that the loan has been repaid and neither party has any more obligations to the other. This can provide legal protection for both parties and prevent future disputes. It can also help ensure that the Borrower's credit report accurately reflects the fact that the loan has been repaid.

In a Release of Loan document, the term "release" refers to being released from any further claims. If the Lender is releasing the Borrower, then this means that the Lender agrees the loan has been fully repaid, as well as any applicable interest and fees, and they have no further legal claims against the Borrower.

It is good practice to attach a copy of the original Loan Agreement (for the loan that is being released), for reference. Once the document has been prepared, the parties may sign it. The parties may each keep a copy of the document for their own records.

It is important to note that the document is structured as a Deed. There are certain formal requirements that need to be met in order for a Deed to be validly signed. If the Parties are unsure about this, they should seek legal advice. If the Parties get this wrong, the Deed may not be legally binding.

The Release of Loan document is structured as a Deed. There are certain formal requirements that need to be met in order for a Deed to be validly signed. A Deed will need to be signed in accordance with those formal requirements, or it may not be legally binding.

For example, for an individual to validly sign a Deed, the signature clause should read "Signed Sealed and Delivered" and they should sign it before an independent adult witness, who also provides their full name and signature.

The rules regarding the signing of Deeds by companies are set out in the Corporations Act 2001, and generally require the Deed to be signed by two directors, or by a director and the secretary or in the event that the company has a sole director who is also the secretary (or a sole director and no secretary), by that person.

If the Parties are unsure about this, they should seek legal advice.

It is good practice to attach a copy of the original Loan Agreement (for the loan that is being released), for reference.

For individuals or partnerships, it is generally necessary to have witnesses for a Deed to be validly signed. In many states and territories of Australia there is legislation which explicitly requires a witness. In some states and territories of Australia it is not legally mandatory, but it is still best practice to do so.

For companies that are signing the Deed under section 127 of the Corporations Act 2001 (by having the directors and/or secretary sign it) then witnesses may not be required.

A Release of Loan should include information such as:

In some cases, if a loan deals with complex matters, the loan may be deemed a complex financial product and may fall under the Corporations Act 2001 (Commonwealth) meaning that additional legal obligations may apply.

Importantly, if the Lender is in the business of providing credit, and if the credit is provided for personal, domestic or household purposes, or for the purpose of purchasing, renovating or improving residential investment property, then the National Consumer Credit Protection Act 2009 (Commonwealth), including the National Credit Code (which can be found at Schedule 1 of that Act) may apply. This may also impose additional legal obligations. Further information is available on the website of the Australian Securities and Investments Commission. If in doubt, seek legal advice. Lenders should review whether the provisions of that Act apply to their lending activities and ensure that they are in compliance with the rules that apply to Australian credit licence holders.

Each state and territory has legislation that addresses the formalities that apply to the signing of deeds by individuals. In addition, the Corporations Act 2001 (Cth) deals with the signing of deeds by companies.

This document is also subject to the general principles of contract law.

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

A guide to help you: What's the Difference Between a Loan Agreement and a Promissory Note?

Release of Loan - sample template online - Word and PDF

Country: Australia